With 2023 drawing to a close, not to mention another potential interest rate hike looming, many Canadians are waiting to see if buying a home is in the cards for them in the coming months.

Over the past year, those with variable-rate mortgages have witnessed a relentless ascent in interest payments, while fixed-rate holders brace for the eventual renewal of their mortgage terms. As it stands, The Bank of Canada's policy rate currently sits firm at 5%, with the prospect of a rate cut remaining uncertain.

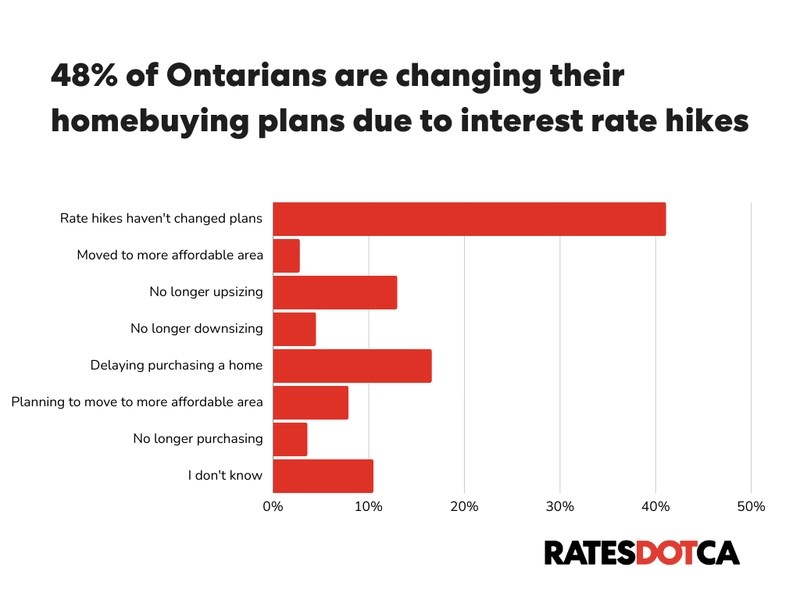

A recent survey from RATESDOTCA provides insight into the mindset of Ontarians amid this financial landscape. According to the results, nearly half of respondents (48%) acknowledge feeling the impact of escalating interest rates on their housing decisions, prompting considerations around moving, upsizing, downsizing, or delaying purchase plans. What's more, 17% have opted to postpone their home-buying aspirations due to these burgeoning rates.

Equally notable is the perceptible shift in attitudes towards homeownership as an investment. Seventeen percent of those surveyed previously viewed buying a home as a sound investment, but the onset of higher mortgage rates has altered their convictions. Moreover, a small yet mighty 4% now express regret over their home purchase decisions.

The Upsizing and Downsizing Dilemma:

Rising inflation and mortgage rates have created a standoff between millennials and baby boomers looking to upsize or downsize. According to the survey, 13% of respondents who planned to move to larger homes have shelved those plans. Millennials, in particular, face hurdles due to stricter mortgage qualifications, leading 10% to abandon homeownership plans and 4% to postpone purchases.

Financial Pressures on Boomers:

As baby boomers near retirement, they grapple with stagnant finances while supporting younger generations. This dual challenge compounds their housing decisions.

Market Dynamics and Relocation:

While it's typical to expect lower prices with higher inflation, something that's beginning to happen with condos and smaller units, single-family home prices, particularly in Toronto, remain high due to sustained demand. Three percent of respondents said they moved to more affordable areas than intended, and 8% adjusted plans to seek more budget-friendly locales due to rising interest rates.

Changing Perceptions on Real Estate:

Traditionally viewed as a prime financial milestone, owning a home is now a more nuanced decision in Ontario. Thirty percent consider it a good investment if financially feasible. Meanwhile, 17% who previously viewed homes as solid investments no longer do, attributing this shift to the impact of interest rate hikes. However, 45% maintain confidence in real estate as a viable investment option.

The convergence of rising interest rates and evolving perceptions around real estate investments paints a compelling picture of the challenges and uncertainties shaping Ontarians' housing aspirations. This report delves deeper into these sentiments, shedding light on the intricate relationship between interest rates and the dreams of homeownership in Ontario.

You can read the full report here.