As the back-to-school season approaches, many parents are focused on more than just tuition fees—they’re also considering the cost of living for their university-bound children.

Whether it’s renting an apartment or purchasing a condo, understanding the financial implications can be crucial in making the best decision. Recent findings from Zoocasa shed light on this important choice, analyzing rental prices and mortgage payments in Canadian university cities.

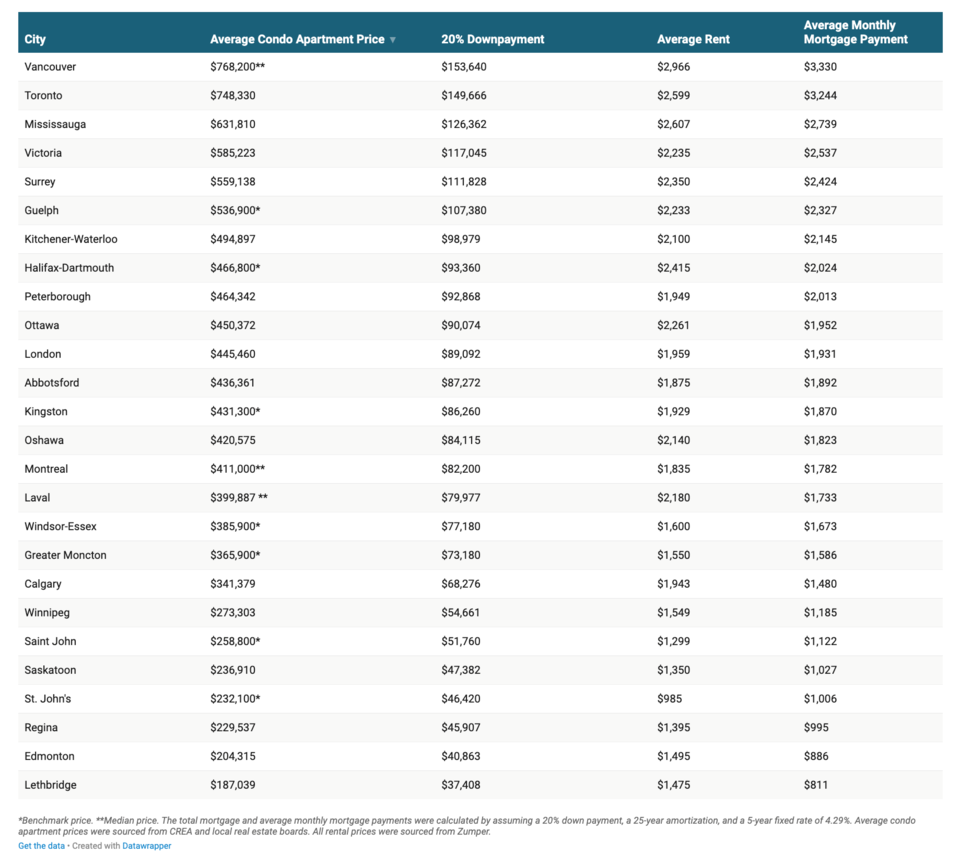

In 60% of the cities studied, owning a condo is more affordable than renting. Western Canada has emerged as a particularly attractive option for university housing, offering both affordability and growth potential. However, Ontario also presents unique opportunities that parents should consider when planning for their child’s university years.

Western Canada

Cities like Edmonton, Lethbridge, and Regina offer condo prices that translate into much lower mortgage payments than typical rents. For instance, Lethbridge boasts monthly mortgage payments of just $811—an impressive $664 less than the average rent. These savings can significantly ease the financial burden of post-secondary education while also allowing parents to build equity in growing markets.

Calgary also presents a compelling case for real estate investment. With a 23% increase in apartment listings over the past year, the city’s housing market offers both affordability and growth potential. Parents or students choosing to purchase could save around $463 per month compared to renting, making it an appealing option in the long term.

Invest or Rent? What Parents Should Consider for University Housing

Ontario’s University Towns: A Strategic Investment

Ontario is home to some of Canada’s most prestigious universities and a diverse real estate market. Cities like Kitchener-Waterloo, Peterborough, and London have become educational hubs, attracting students from across the country. In these cities, the cost difference between renting and buying is often minimal, making real estate a viable long-term investment. For instance, in Kitchener-Waterloo, known for its thriving tech sector and universities, the gap between monthly rent and mortgage payments is narrow, allowing parents to build equity while providing a stable living environment for their children.

In Peterborough, home to Trent University, and in London, where Western University is located, the market presents similar opportunities. The monthly cost of a mortgage in these cities can be just slightly higher than rent, making homeownership a practical option for those looking to invest in their child’s future.

Urban Centres: Balancing Cost and Investment

Toronto and Mississauga, two of Ontario’s largest urban centres, present different challenges. The average condo price in Toronto is high, leading to substantial mortgage payments. However, these cities offer significant advantages, such as strong rental demand and long-term appreciation. For parents willing to invest in these markets, the potential for property value growth and rental income can outweigh the higher upfront costs.

Mississauga, with its more moderate price point, provides a balance between affordability and investment potential. With an increasing number of listings, buyers have more options to find properties that fit their budget, making it an appealing choice for families.

Making the Right Choice

Ultimately, the decision to buy or rent will depend on individual financial circumstances, but understanding the potential benefits of real estate investment in university cities is an essential part of planning for your child’s future.