As the leaves change and the chill of autumn sets in, Canadians are witnessing more than just a transformation in nature. According to recent data from Rentals.ca, the country's rental market continues to experience upward pressure, with asking rents hitting new highs in September.

The numbers reveal an unceasing trend of growth, with some regions seeing an even more significant spike in rental rates.

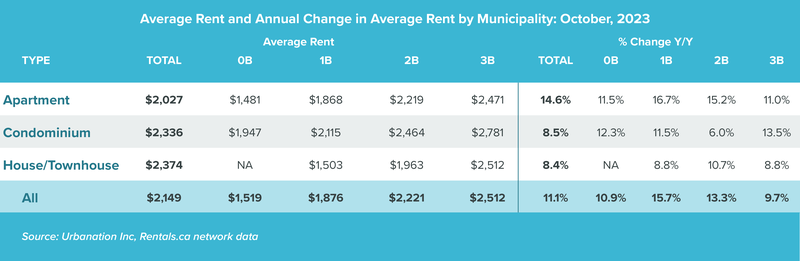

In September, the national average for rental rates in Canada reached $2,149, marking a 1.5% increase from August and a staggering 11.1% rise from the previous year. This surge in rental prices places the annual rate of rent inflation at a nine-month high, suggesting a compelling demand for rental properties across the country.

Regional Insights: Where's the Growth?

Ontario's Shift in Rental Trends:

Ontario, home to vibrant cities like Toronto and Ottawa, has experienced a noticeable transformation in its rental landscape. Toronto, in particular, saw a substantial slowdown in its annual rate of rent growth last month. This change may indicate an impending moderation in rent inflation, coinciding with a cooling economy and mounting affordability challenges for renters. The data also highlights a significant rise in rental activity for shared units, suggesting an evolving housing market in the province.

One-Bedroom Apartments Taking the Lead:

When it comes to the types of rental properties seeing the most significant increases, one-bedroom apartments have taken the spotlight. The data reveals that one-bedroom apartments have recorded the fastest annual growth in asking rents, surging by an impressive 15.5% to reach an average of $1,905. Two-bedroom apartments aren't far behind, with a 13.1% annual increase to an average of $2,268, while three-bedroom units saw rents rise by 11.4% to an average of $2,514. Even the more affordable studio apartments saw their rents grow by 11.3%, reaching an average of $1,511.

Provincial Highlights: Nova Scotia and Alberta in the Lead

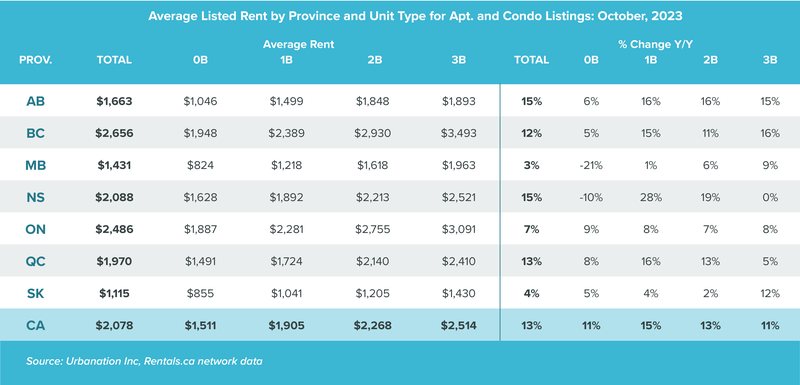

Provincial insights from the report highlight Nova Scotia and Alberta as leaders in the annual rate of rent growth for purpose-built and condominium apartments in September. Nova Scotia saw an impressive 15.4% increase, with average asking rents reaching $2,088, while Alberta's rates surged to $1,663.

Quebec boasted the third-fastest annual growth rate, with asking rents increasing by 13%. British Columbia closely followed, with a year-over-year growth rate of 12.3%, though asking rents in BC were the highest among all provinces at $2,656, while Quebec's rents were slightly below the national average at $1,970.

Challenges and Slowdown in Ontario:

In Ontario, while the annual rate of rent growth has slowed from 9.9% in August to 6.6% in September, the province's rents remain among the highest in Canada. The asking rents in Ontario experienced a slight 0.4% month-over-month decline, with an average of $2,486.

Prairie Provinces: Slower Growth

The Prairie provinces of Saskatchewan and Manitoba have seen the slowest annual rent growth in September, with rates of 3.8% and 3.1%, respectively. Asking rents averaged $1,115 in Saskatchewan and $1,431 in Manitoba.

Municipal Highlights: Insights from Canada's Largest Cities

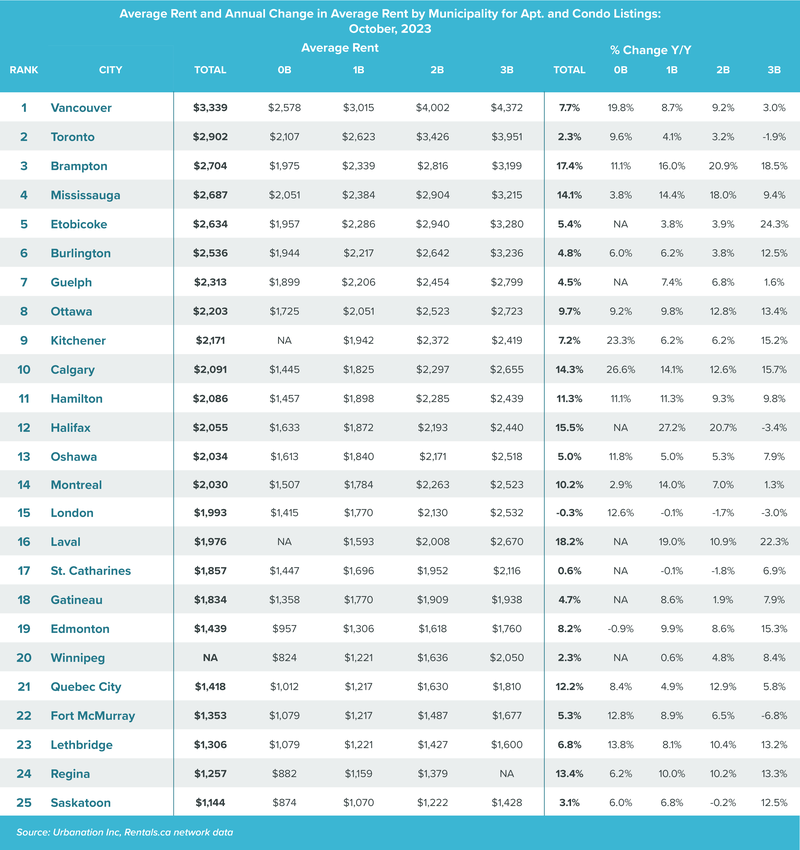

As we delve into the specifics of Canada's urban landscapes, several cities continue to stand out. Calgary leads the pack with annual growth in asking rents for purpose-built and condominium apartments, registering a substantial 14.3% increase in September, reaching an average of $2,091. Meanwhile, Montreal has managed to maintain double-digit rent increases, with average asking rents rising by 10.2% year-over-year to $2,030.

Interestingly, the annual rate of rent growth in Toronto witnessed a significant slowdown in September, dropping to 2.3% from 8.7% – the slowest annual increase in two years. The city also experienced little change in rents on a month-over-month basis, increasing by just 0.1%.

Expensive Rental Markets: Vancouver and Toronto Surroundings

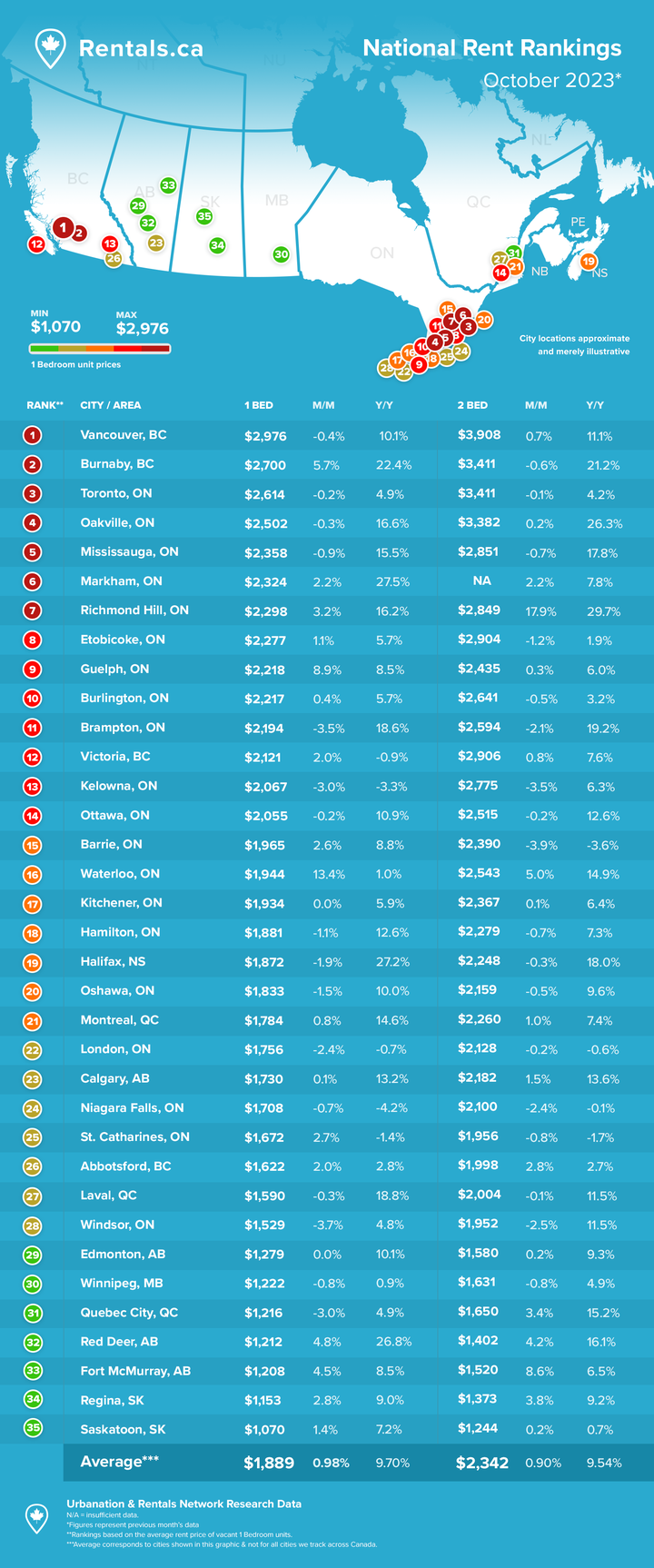

Canada's mid-sized markets have continued to see robust annual rent growth in purpose-built and condominium rental apartments. Among these, Richmond (part of Greater Vancouver) stands out with a remarkable 28.9% growth rate. It's followed by Cote-Saint-Luc (part of Greater Montreal) at 27.5%, and Red Deer, Alberta, with a 21.8% annual increase.

Outside of Canada's major cities, Richmond (part of Greater Vancouver) continues to dominate with the highest annual rent growth. Notably, four of the five most expensive mid-sized markets in Canada were located in Greater Vancouver, with North Vancouver topping the list at an average asking rent of $3,481 for purpose-built and condominium apartments.

Ontario's most expensive markets outside of Toronto also belong to the Greater Toronto Area. Oakville led the pack with average asking rents of $2,960 for purpose-built and condominium apartments, followed by Brampton ($2,704), Vaughan ($2,697), Mississauga ($2,687), Etobicoke ($2,634), and North York ($2,629).

The Rise of Roommate Rentals:

One of the most intriguing trends emerging from the report is the surge in roommate rental listings. Renters looking to reduce costs through shared accommodations and property owners seeking to offset their rising mortgage payments have led to a 27% increase in the volume of shared accommodation listings over the past three months compared to the previous year. This surge was particularly notable in British Columbia, with a 40% increase in listings, and Ontario, with a remarkable 78% increase.

The report shows that average asking rents for shared accommodations have also seen an 18% year-over-year increase, reaching $944 per month. In British Columbia, roommate rentals averaged $1,156 per month, reflecting a 17% annual increase. Alberta also witnessed a 20% year-over-year surge, with rents for roommate units rising to $857. Ontario and Quebec recorded average asking rents of $1,049 and $864 for shared accommodations, showcasing annual growth rates of 8% and 19%, respectively.

The highest asking rents for shared accommodations during September were reported in Vancouver, averaging $1,590, and Toronto, reaching $1,308.

In conclusion, the Canadian rental market continues to experience robust growth, with annual rent inflation rates reaching new highs, particularly in certain provinces and cities. The rise in shared accommodation listings demonstrates the changing dynamics in the rental market as renters and property owners adapt to affordability challenges. These findings reflect the evolving landscape of Canada's rental market and shed light on the trends shaping the future of housing in the country.